WOODBURY — Quick money, risky, gambling, long term? These are all thoughts teens consider when asked about investing. Fortunately, for Nonnewaug students, there are multiple courses that help introduce teenagers to the complex world of finance.

According to a CNBC survey, “39% of teens see the stock market as an opportunity to ‘make money quickly,’ while 20% believe it’s ‘too risky.'” However, 40% still think stocks are a “good long-term investment,” and the survey revealed 80% of teens think the stock market is a “good investment.”

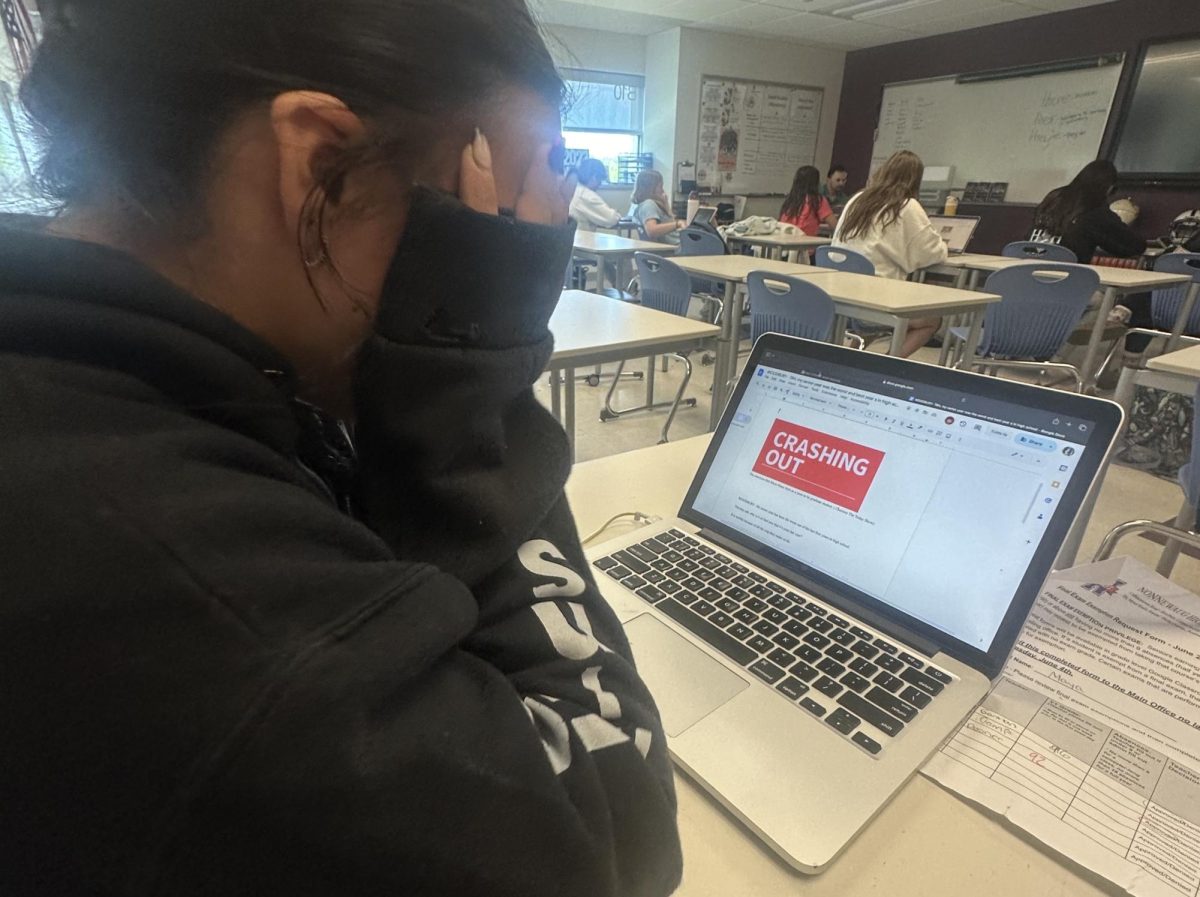

Unfortunately, merely thinking is all most teens do regarding the prospect of investing their money as many young people fail to ever truly invest. According to Yahoo Finance, teens spend most of their money on clothing and food, and almost little to no money on investing. This begs the question: Why aren’t teens investing?

Many teens are vulnerable to spending their money on clothes, food, health and beauty, and technology products. When teenagers get money, whether it’s from their parents or their job, many don’t have any plans on how to spend it. This leads to an issue: a spending frenzy on nonessential, frivolous items.

What could be a possible solution so teens could start planning out their finances?

Fortunately, for NHS students, there are classes that can educate students on what to do with their money.

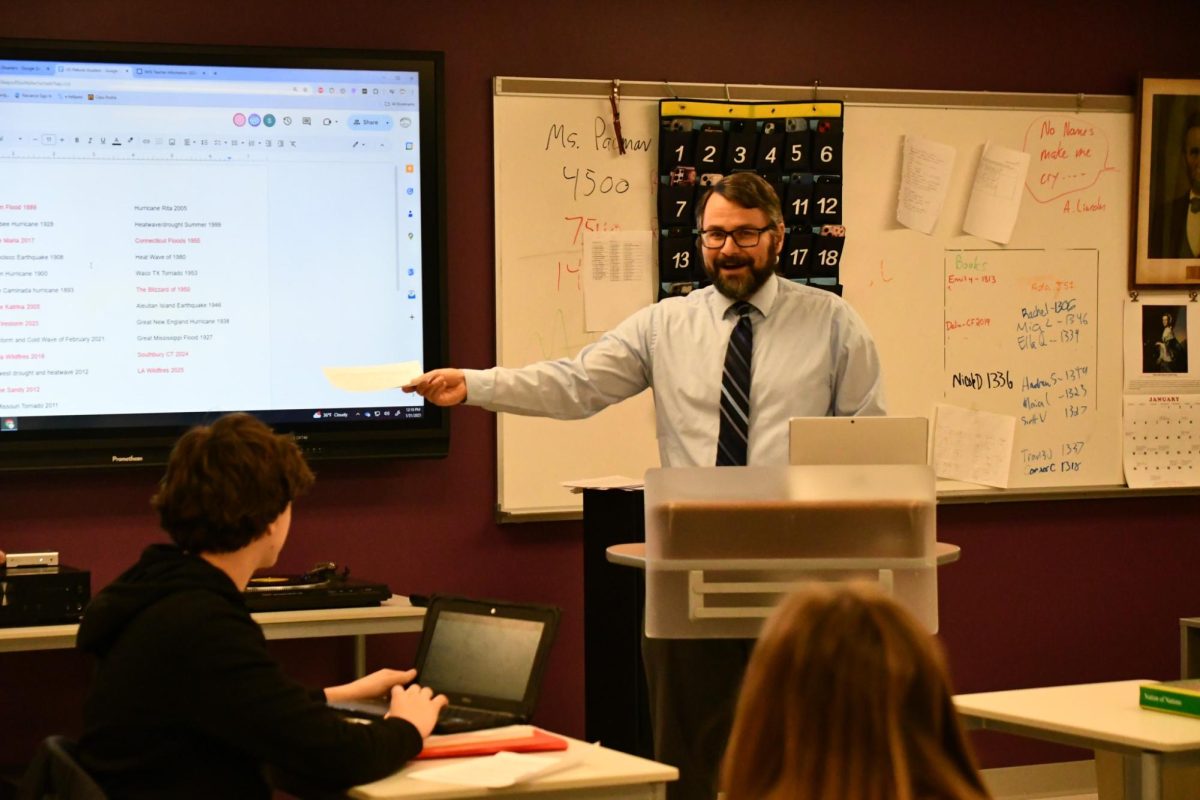

“All freshmen next year are required to take personal finance to graduate,” said Adam Lengyel, a business teacher at Nonnewaug.

A Connecticut state law that went into effect for the class of 2027 will mandate students gain exposure to financial education.

At Nonnewaug, there are very few students actively investing and applying the concepts learned from NHS’ financial courses. One of the only students at Nonnewaug who does invest in the market is senior Reece Davis.

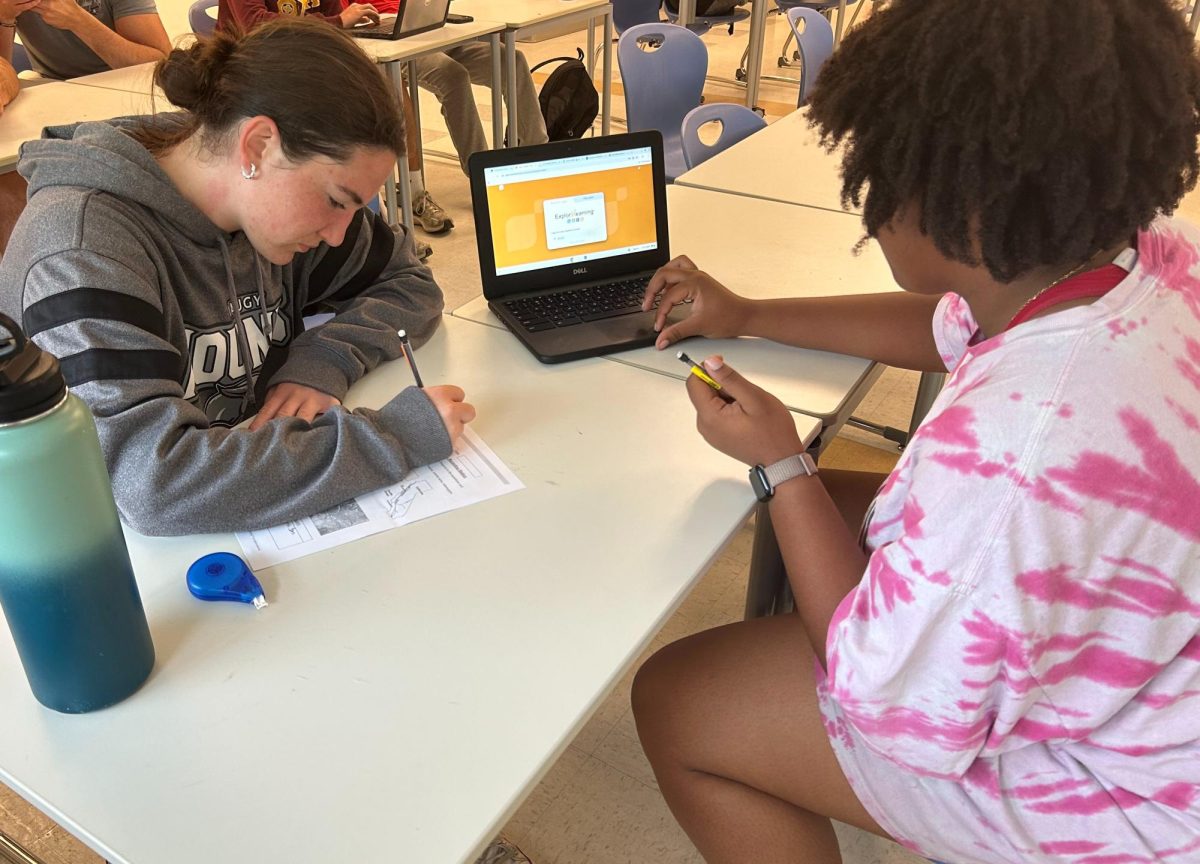

Davis has been accepted to Fordham University and will major in business finance. While he is not at school, he is most likely learning and studying the market, using the foundation he learned through NHS’ business program. Davis applies his knowledge from NHS’ financial courses and uses his period 3 study hall to analyze the market during Wall Street’s opening bell.

This is not something that anyone can do. Davis has been investing since he was 13 years old. Once Davis entered high school, he was able to hone his interests even further.

“Mr. [Devon] Bares’ Marketing I class really showed me how supply and demand work together,” Davis said. “This further helped me understand how the stock market works.”

Lengyel and Bares both bring their own personal experiences to their courses as they guide students through the investing process.

While Bares actively manages his own portfolio, Lengyel advises his financial advisor based on his own research.

Both Bares and Lengyel see their courses as a roadmap to a variety of careers in the financial industry. Some of these careers involve actively managing a financial portfolio while others may only include finance as a small part of there future career.

“I think any type of business education is a positive for promoting investing and financial literacy,” Lengyel said.

Bares and Lengyel know not every student will become the next Warren Buffet, America’s modern day real estate tycoon who at the age of 11 bought his first stock and by 14 bought a 40-acre farm. But both instructors know their courses have the power to change the financial health of an entire generation.

“[Financial education courses] prepare them for experiences they are going to have in the future,” said Lengyel. “Whether it’s in college or their own personal lives, these are skills they can take with them for the rest of their lives.”

This is the opinion of Chief Advocate reporter Lucas Almeida, a senior at Nonnewaug and a small business owner.