WOODBURY – Seniors are preparing to step into the real world after graduation, armed with knowledge. Sure, we can solve for x and we have the ability to understand what the theme of Romeo and Juliet is, and maybe we can even recite the Declaration of Independence, but are we prepared enough?

It’s time our education system does more than just prepare us for tests – preparing us for the real-world realities of dealing with our personal finances would be nice, too.

Think about it: Every student should have an understanding of banking, investing, saving, how to navigate taxes, paying bills, and acquiring experience with the use of credit and debit cards, especially before they graduate as legal adults.

Some might say that it’s not like we’re being thrown into the deep end of life without a financial floatie. I mean, who really needs those practical life skills anyways, when we can just wing it and hope for the best, right?

Wrong.

It’s not just nice-to-have knowledge – it’s essential for us young adults heading into the real world. Thankfully, Connecticut governor Ned Lamont is acknowledging that.

His legislation for a required personal financial management course is a step in the right direction for us high school students. According to CT.gov, beginning with the class of 2027, students will be required to complete a half-credit course in financial management and literacy in order to graduate from Connecticut public high schools.

“We should absolutely have a class like that in high school,” said Kayci Hungerford, a senior at Nonnewaug. “Everyone will have to deal with finances every day for the rest of their life.”

Connecticut will be the 22nd state to enact a personal finance curriculum as a prerequisite for graduation. With less than half of the states in the U.S. requiring financial coursework, many agree with increasing that number.

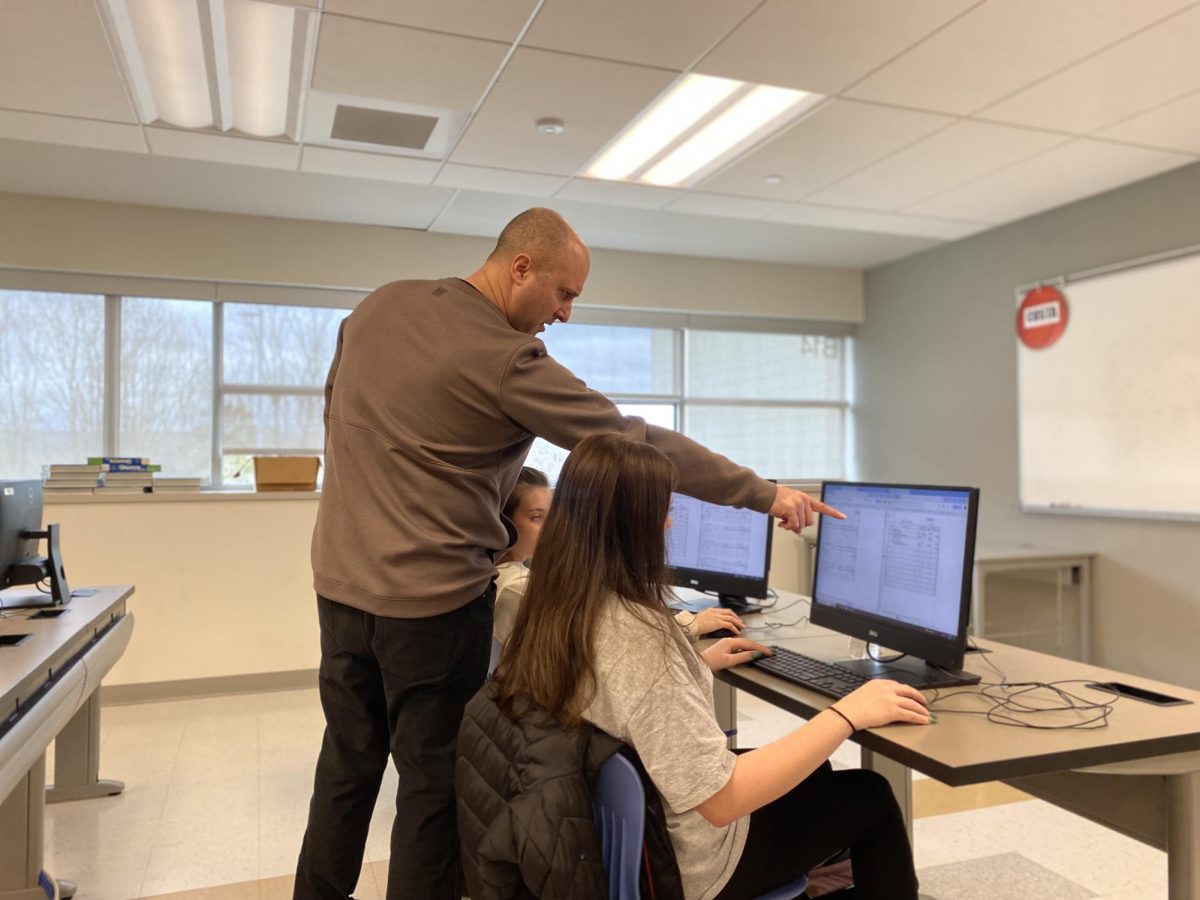

“I graduated from Shelton High School, and I don’t think we even offered a personal finance course,” said NHS business and finance teacher Adam Lengyel. “I was lucky enough to learn a lot when I first started teaching personal finance, and I was able to apply it to my personal life.”

There is a surprising lack of financial literacy in U.S. adults, young and old. 25% of American adults don’t have anyone to ask for trusted financial guidance, according to Zippia statistics from 2023. A mere 25% of teenagers have confidence in their personal finance knowledge.

“Many students leave high school without the ability to even write a check,” said Moorea Santulli, an NHS senior.

Where else are teenagers expected to learn these skills?

“I do wish schools would teach about finances more because I feel like it’s a life skill you need to know for the real world, and it would be nice to learn it in a school setting since you’re already in that educational environment,” said Nonnewaug senior Kylieann Craine. “Plus, not everyone has an opportunity at home to learn finances from a parent or sibling. It might just be easier for some students to be able to learn these skills from a teacher.”

It’s a great step forward. However, we shouldn’t just stop there.

I’ll agree, even learning just the basics of financial management – like investing, saving, paying bills, doing taxes, responsible use of credit and debit cards – will help society in the future. The major limitation that I see, though, is that the new required curriculum could end up like getting a free trial of an app on your phone: you know there should be more to it, but there’s not.

Raise your hand if you believe that the financial management class should be more than just a lesson on saving pennies. That the ultimate goal should be for students to learn and understand everything from taxes, to bill payment, house mortgages, insurance policies, credit scores, and more.

My hand is raised.

Learning just the basics does assist students for their future, but there’s so many branches of financial management to go in depth with, giving students a better shot at financial success.

Think about how much information goes into just insurance on its own, in addition to the many other financial skills.

“If everyone practices good financial habits and financial management skills,” said Lengyel, “then our economy and society is in a better place.”

Although Nonnewaug already offers an optional personal finance course, who’s willingly signing up for that class, unless they plan on being the next big banker or insurance guru? Not exactly everyone’s cup of tea.

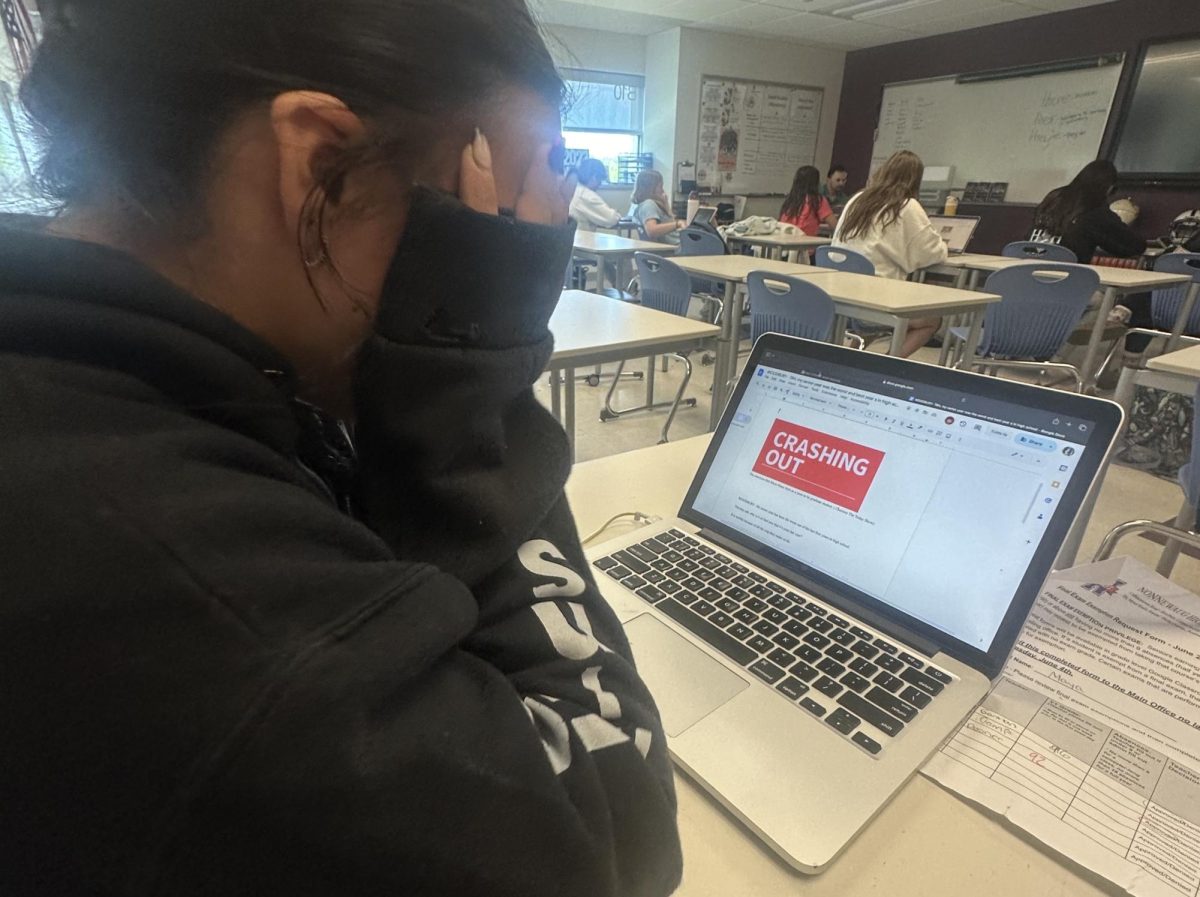

But hey, being a senior myself, I wish I’d snagged a seat in that class in hindsight. Because honestly, how am I supposed to do all this adulting after high school?

Without these skills, adulthood just doesn’t compute.

This is the opinion of Chief Advocate reporter Jillian Brown, a senior at Nonnewaug.